Trump’s Prescription Drug Price Cuts: What Does It Mean for Consumers and the Pharmaceutical Industry? (Up to 80% Reduction)💊💸

Is this something you’ve been wondering about—how much can we really save on prescription drugs, and how could it impact the pharmaceutical industry as a whole? Well, let’s dive right into it!

After analyzing everything across the internet and gathering real-world insights, the Bhussan.com team shares this friendly, helpful article to break down Trump’s Prescription Drug Price Cuts by up to 80%. Let’s explore what’s at stake, how it could reshape the market, and what this could mean for both consumers and pharma companies.

Prescription Drug Prices in the U.S. have long been a pain point for millions of Americans — but what if those sky-high costs were suddenly slashed by up to 80%? Sounds unbelievable, right? Well, former President Donald Trump just announced a bold plan to do exactly that, and the shockwaves are already hitting the global pharmaceutical industry. Is this something you’d want to search the entire internet for, analyze, and separate truth from noise?

After analyzing everything across the internet and gathering real-world insights, the Bhussan.com team shares this friendly, helpful article to break it all down for you — the real impact on your wallet, what the pharma giants are scared of, and what this means for the future of healthcare.

Breaking News:🚨Trump’s Bold Drug Pricing Plan

On May 12, 2025, former U.S. President Donald Trump took a dramatic step toward tackling one of the most persistent issues in American healthcare: expensive prescription drugs. In a surprise announcement, he vowed to reduce drug prices by as much as 30-80%. This move, aimed at benefiting American consumers, has caused quite a stir in the stock market and within the pharmaceutical industry.

Why is this such a big deal?

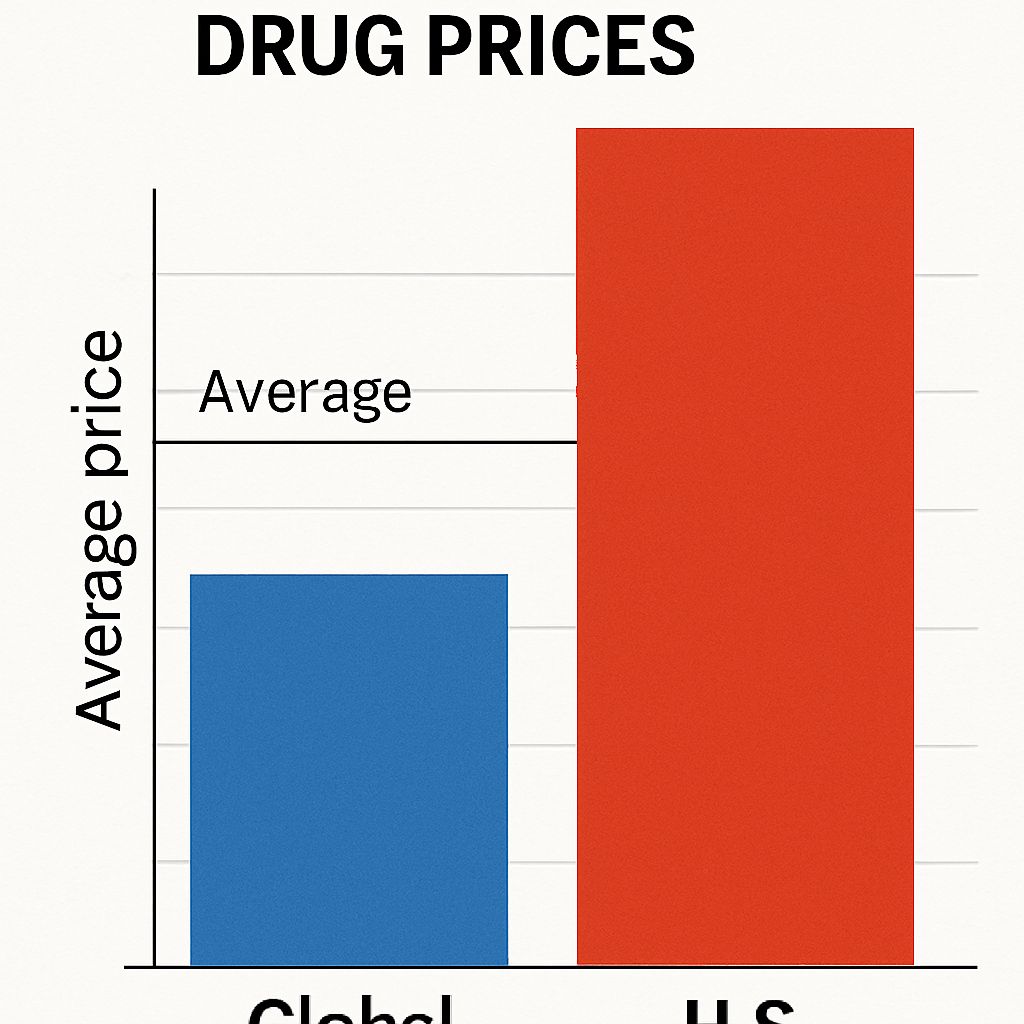

If you’ve ever stood at the pharmacy counter staring at the total cost for a single medication, you probably know exactly how frustrating the high prices can be. In fact, Americans are often charged up to four times more for prescription medications than people in other countries. Trump’s proposal is meant to level the playing field, aiming to cut down those excessive costs by aligning U.S. drug prices with those of other nations.

What’s the plan?

The proposed policy is called the “Most Favored Nation” (MFN) pricing model. The idea is straightforward: the U.S. would pay no more for prescription drugs than the lowest price paid by any other country. This could mean massive price cuts for consumers, but it also raises concerns for pharmaceutical companies that rely on the high U.S. prices for revenue.

Why Trump’s Move on Prescription Drug Prices Is Making Headlines🧪

For years, prescription drug prices in the U.S. have been among the highest in the world. Patients often skip doses or delay treatment because they simply can’t afford the medications they need. Now, with Trump’s vow to slash prescription drug prices by up to 80%, we’re witnessing a turning point in American healthcare.

But how realistic is it? And what will it really mean for your next pharmacy bill? Experts say the proposal could drive massive changes, not only in the U.S., but across global drug pricing models too.

📉 The Immediate Reaction: Pharma Stocks Take a Hit

Trump’s announcement didn’t go unnoticed by the market. Pharmaceutical companies—both American and international—saw their stocks take a nosedive. Let’s take a look at some of the most notable impacts:

U.S. Pharmaceutical Stocks

-

Pfizer Inc. (PFE): Dropped 0.65%, closing at $22.28

-

Johnson & Johnson (JNJ): Fell by 0.91%, ending the day at $154.22

-

Merck & Co. Inc (MRK): Down 1.53%, closing at $75.97

These declines reflect investor worries about the potential revenue loss from this massive pricing overhaul. If the U.S. starts paying much less for drugs, pharmaceutical giants may face a decrease in profit margins—something Wall Street clearly doesn’t like.

Impact on Indian Pharma Stocks

The impact wasn’t limited to American companies. Indian pharmaceutical companies, who export a significant portion of their products to the U.S., also felt the pinch:

-

Sun Pharma: Dropped 4.6%

-

Cipla, Zydus Life, Divi’s Laboratories, and Lupin: Each saw declines in the range of 0.7% to 2%

Given that the U.S. is a massive market for India’s generics, this pricing policy could drastically impact profit margins for these companies as well.

🏛️ What Exactly Is the “Most Favored Nation” Pricing Model?

Trump’s MFN plan is designed to shake things up in the way drug prices are set in the U.S. Right now, the U.S. has some of the highest drug prices in the world, mainly due to the lack of regulation and price negotiations that occur in countries like Canada, the UK, and parts of Europe. The idea is simple but profound:

-

Price Matching: The U.S. will no longer pay higher prices for medications than countries with the lowest drug prices.

-

Global Price Comparison: This could mean that U.S. consumers finally get access to more affordable medication, potentially lowering costs for millions of people.

In short, the Most Favored Nation pricing model allows the U.S. to mirror the lowest prices found across the globe, aiming for drastic reductions in costs for common medications like insulin, cancer treatments, and antibiotics.

🌍 Global Impacts: What Does This Mean for the Rest of the World?

The U.S. market is a key player in the global pharmaceutical industry. Any shifts in pricing could have ripple effects worldwide. Here’s a breakdown of potential outcomes:

For Pharmaceutical Companies:

-

Revenue Declines: Companies that rely on U.S. sales will likely see a reduction in revenue due to lower prices.

-

Research and Development: A potential drawback is that reduced income could lead to lower investment in R&D, which could slow the development of life-saving medications in the future.

For Consumers:

-

Lower Costs: The most obvious benefit is that U.S. consumers could see massive reductions in their monthly medication costs, easing the financial burden on millions of households.

-

Access to Drugs: Price reductions could also open the door for more people to access life-saving medications that were once out of reach.

🧠 Experts Weigh In: What Could Go Wrong?

While the policy has good intentions, experts in the pharmaceutical industry have voiced some concerns:

-

Legal Challenges: In 2020, a similar proposal was blocked by the courts, and many expect that this new plan will face legal pushback.

-

Innovation Risks: Lower revenues could discourage pharmaceutical companies from investing in new drug development, potentially stalling innovation in treatments for diseases like cancer, Alzheimer’s, and rare conditions.

-

Market Disruption: Shifting pricing models on such a large scale could disrupt the market in unforeseen ways, especially if pharmaceutical companies are forced to adapt quickly to changing regulations.

🏢 The Indian Pharma Industry: At the Crossroads

India plays a critical role in the global generic drug market, and the U.S. is one of its largest export markets. With Trump’s potential pricing policies, Indian pharma companies could face significant losses. If U.S. drug prices are cut by 30-80%, companies like Dr. Reddy’s, Aurobindo Pharma, and Zydus Lifesciences might see earnings per share drop by 4% to 6.5%.

Additionally, potential 25% tariffs on drug imports into the U.S. add to the strain. The Indian pharmaceutical industry could be looking at a double whammy—pricing cuts and higher tariffs—both of which would impact profitability.

📊 Pros and Cons of Trump’s Prescription Drug Pricing Policy

| Pros 🌟 | Cons 🌧️ |

|---|---|

| Lower drug prices for U.S. consumers. | Revenue loss for pharmaceutical companies. |

| Increased accessibility to essential drugs. | Potential slowdown in medical research. |

| Global impact on drug pricing. | Legal battles over the policy. |

| Greater price transparency in the U.S. | Job loss in the pharmaceutical sector. |

📚 FAQs: Everything You Need to Know

-

How much will U.S. drug prices drop under Trump’s plan?

-

Trump aims to cut drug prices by as much as 30-80%, depending on the medication and the market.

-

-

Why are pharmaceutical stocks falling?

-

Investors are concerned that price reductions will result in lower profits for pharmaceutical companies.

-

-

How will this affect Indian pharmaceutical companies?

-

Indian pharma companies that export to the U.S. might see a decline in revenue, particularly if U.S. drug prices fall significantly.

-

-

What is the Most Favored Nation (MFN) pricing model?

-

It’s a system where the U.S. will pay no more for drugs than the lowest price paid by any other country.

-

-

Can this policy improve healthcare accessibility?

-

Yes, it could make medications more affordable for millions of Americans.

-

Conclusion: The Road Ahead

Trump’s proposal to cut prescription drug prices has the potential to reshape the healthcare landscape in the U.S. for the better. While the immediate impact on pharmaceutical stocks has raised alarms, the long-term effects could be beneficial for consumers. Whether or not the policy survives legal challenges and market disruptions remains to be seen.

Call to Action: Stay informed about the developments in this policy, as it could have far-reaching consequences for both consumers and the pharmaceutical industry. Share your thoughts—do you think this is the change we need, or could it backfire?