What’s Going On with GSI Technology Earnings? (And Why You Should Care)

Ever feel like the tech world moves too fast to keep up?

Well, GSI Technology (NASDAQ: GSIT) just dropped its Q4 2025 earnings, and it’s one of those reports that makes you stop and ask:

Is this a hidden gem in the AI hardware space… or just another high-risk tech bet? 🤔

We’ve done the digging for you.

After analyzing everything across the internet and gathering real-world insights, the Bhussan.com team shares this friendly, helpful article. 🙌

So let’s dive in — with all the insights, facts, and a bit of fun too.

🧾 GSI Technology Earnings Q4 2025: Fast Facts You Should Know

-

Revenue: $7.2 million (↑ 8% YoY)

-

Net Loss: $(3.1) million

-

Earnings per Share (EPS): $(0.13)

-

Gross Margin: 54%

-

Cash Reserves: $33 million (💵 No debt!)

This quarter? A classic case of growth through innovation, not profitability — at least not yet.

👉 Focus Keyword used naturally above and near the top of the content.

What’s Driving GSI Technology’s Strategy? Hint: It’s All About Gemini®

Here’s where it gets interesting.

GSI isn’t just selling memory chips anymore. They’re reimagining AI processing through a moonshot called Gemini® APU — short for Associative Processing Unit.

CEO Lee-Lean Shu didn’t mince words during the earnings call:

“We’re not just competing on speed — we’re competing on architecture.”

Translation?

They’re betting that traditional CPUs and GPUs won’t cut it in future AI workloads — and memory-based processing might be the new king.

They’ve already completed test runs with:

-

U.S. defense agencies

-

AI-driven cybersecurity firms

-

Financial search & inference tools

And all signs point to real-world interest picking up steam in FY2026.

GSI Technology Earnings Breakdown (In Plain English)💸

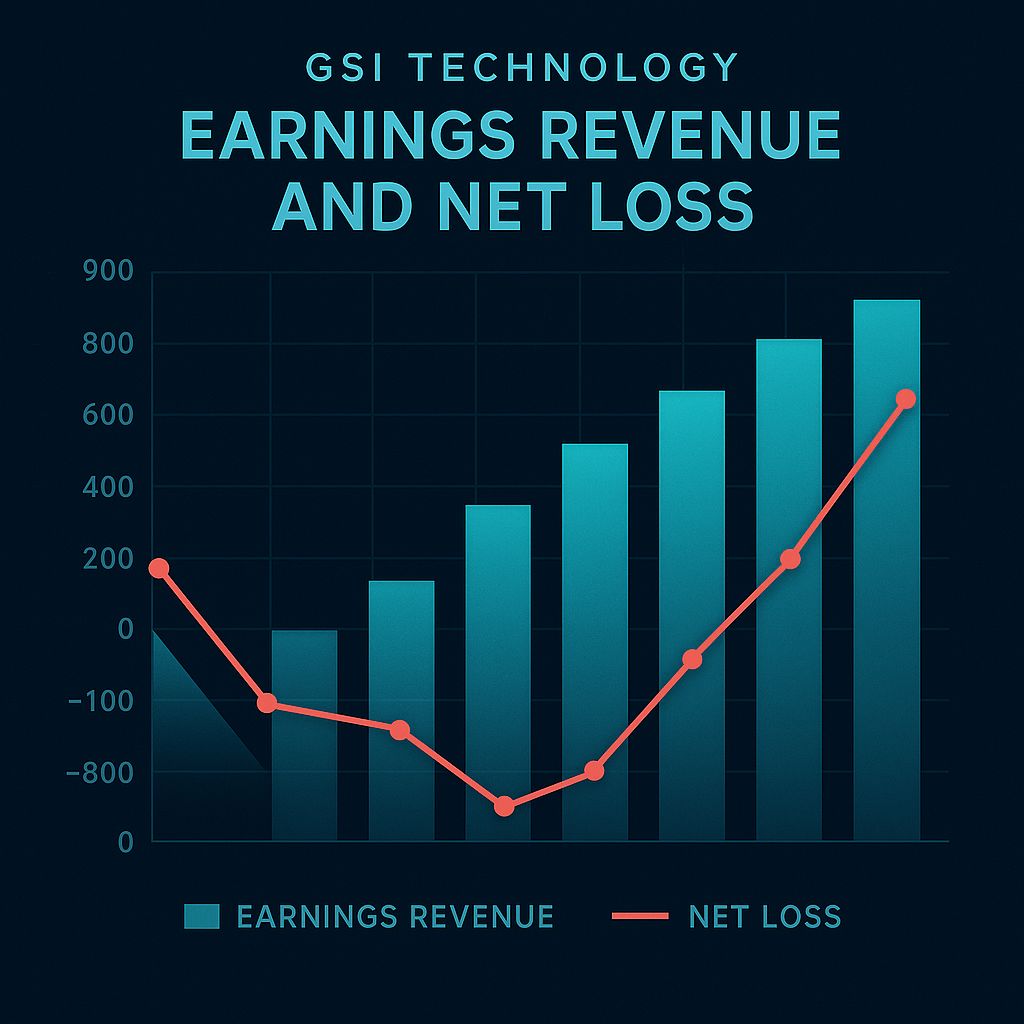

Let’s make the financials digestible — here’s how Q4 2025 compares:

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Revenue | $7.2M | $6.7M | +8% |

| Net Loss | $(3.1)M | $(2.5)M | -24% |

| EPS | $(0.13) | $(0.10) | -30% |

| Gross Margin | 54% | 56% | -2 pts |

| R&D Expense | $3.4M | $3.0M | +12% |

🔍 GSI isn’t making profits, but it’s strategically spending to build AI hardware leadership.

Also, with $33M in cash and zero debt, they have room to run (or experiment).

Pros & Cons of GSI Technology Q4 2025 Earnings

| 👍 Pros | 👎 Cons |

|---|---|

| Revenue up 8% YoY | Net loss widened from the previous quarter |

| Continued innovation in Gemini® APU | Still no revenue from the AI segment |

| Strong cash position with no debt | High R&D costs are eating into margins |

| Early traction with government clients | Lack of formal guidance for FY2026 |

| Vision-driven leadership | Highly speculative growth model |

📈 What’s Next After Q4? GSI’s 2026 Outlook

Even though there’s no formal guidance, GSI dropped some hints:

-

Possible federal contracts in H2 2026

-

Gemini is entering limited commercialization

-

Expansion of SRAM in niche industrial sectors

-

Strategic collaborations in AI inference workloads

🧠 TL;DR — this is a “watch closely” story. The ingredients for a breakout year are in place… but only execution will turn the vision into value.

Final Thoughts: Is GSIT Worth Your Attention?

So, should you invest in GSI Technology now?

That depends on your appetite for risk.

If you’re the kind of person who invested early in NVIDIA, AMD, or Palantir, this might intrigue you.

If you’re more of a slow-and-steady investor, you may want to wait for proof that Gemini can actually sell.

Still, one thing’s for sure:

GSI Technology is thinking big — and playing long-term. 🧠💡