Pakistan IMF Loan 2025: What the $2.3B Bailout Really Means for the Region🧪

Is this something you want to search the entire internet for, analyze it, and separate it from everyone else?

You’re in luck! After analyzing everything from the internet and gathering real-world insights, the Bhussan.com team has shared this friendly, helpful article.

May 10 (Bhussan)The International Monetary Fund (IMF) executive board approved the first review of its $7 billion program with Pakistan on Friday, disbursing $1 billion in cash, the Pakistani government said on Friday.

“Prime Minister Muhammad Shehbaz Sharif expresses satisfaction over the approval of a $1 billion tranche by the International Monetary Fund (IMF) for Pakistan,” his office said in a statement.

A Financial Lifeline Amidst Turbulence🌐

Imagine standing on the edge of a financial abyss, with the world’s eyes glued to your every move. That’s where Pakistan found itself in May 2025, facing a storm of economic chaos. With foreign exchange reserves plummeting, inflation biting hard, and a ballooning debt burden, it was only a matter of time before international help was needed. And that help came in the form of the much-discussed Pakistan IMF Loan 2025.

The International Monetary Fund (IMF) stepped in with a hefty $2.3 billion bailout. The deal offered a temporary cushion—meant to stabilize Pakistan’s crumbling economy and prevent a full-scale collapse. While the IMF’s approval brought hope to many, it also stirred controversy on the global stage.

One of the most striking reactions came from India, Pakistan’s neighbor and long-time geopolitical rival. India abstained from voting on the Pakistan IMF Loan 2025, raising serious concerns over how the money might be used. Indian officials pointed to Pakistan’s historic misuse of funds and alleged links to financing terrorism. This wasn’t just a diplomatic gesture—it was a loud statement to the international community.

So what exactly does the Pakistan IMF Loan 2025 mean for the country’s future? Will it act as a real recovery mechanism, or just delay another economic crash? Can Pakistan implement the structural reforms needed to truly benefit from this lifeline, or will history repeat itself?

These are the questions we’ll explore in depth. After analyzing everything across the internet and gathering real-world insights, the Bhussan.com team shares this detailed, friendly, and easy-to-read guide—breaking down the facts, the politics, and the potential outcomes of this pivotal financial decision.

Breaking Down the Pakistan IMF Loan 2025💰

On May 9, 2025, the IMF greenlit a total of $2.3 billion in financial support for Pakistan:

-

$1 Billion under the Extended Fund Facility (EFF), raising the total under this facility to $2 billion.

-

$1.3 billion under the Resilience and Sustainability Facility (RSF) to be disbursed over 28 months.

This decision was made despite India’s vocal objections during the IMF Executive Board meeting.

🇮🇳 India’s Response to the IMF Loan: Why the Abstention?

India didn’t just vote no—it walked away from the table. Here’s why:

-

Terror Financing Concerns: India warned the funds could indirectly support terrorist activities.

-

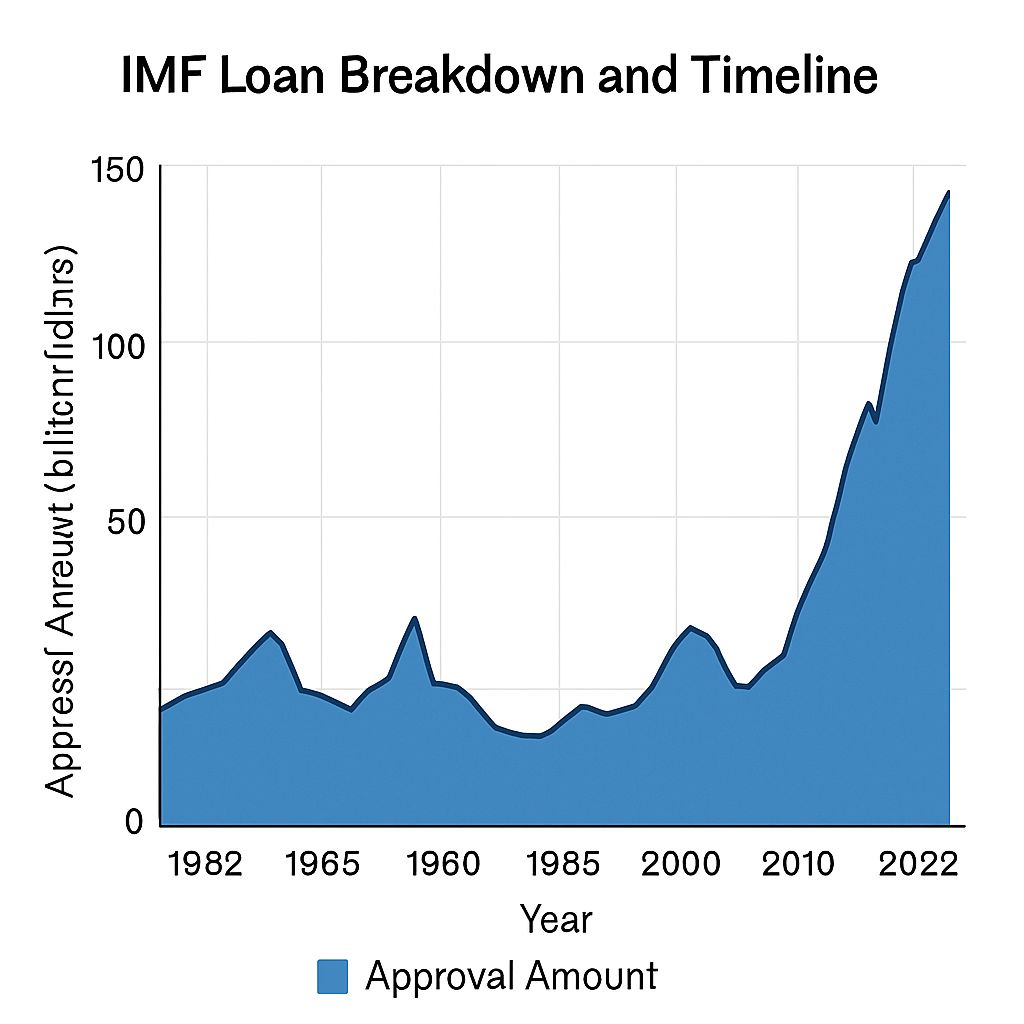

Historical Mismanagement: Pakistan has received IMF funds 28 times in the last 35 years. Critics question whether real progress is ever made.

-

Moral Accountability: India stressed that global finance must reflect global ethics.

India’s abstention, while symbolic, sent a clear message to the global community.

What This Means for Pakistan’s Economy🌎

The IMF loan is a short-term relief. But will it fix long-term issues?

Benefits:

-

Replenishes foreign reserves

-

Supports climate-related reforms via RSF

-

Boosts investor confidence (temporarily)

Risks:

-

Could increase the debt burden

-

May not enforce deep reforms

-

External dependency continues

The real question: Will Pakistan make the tough choices needed for sustainable growth?

✅ Pros & ❌ Cons Table

| Pros | Cons |

|---|---|

| Provides short-term financial stability | Risk of fund misuse |

| Supports green and climate resilience reforms | Relies heavily on external borrowing |

| May improve global investor confidence | Could worsen regional tensions with India |

FAQs About Pakistan’s IMF Loan 2025❓

-

-

What is the total amount approved by the IMF for Pakistan in 2025?

-

$2.3 billion, comprising $1 billion under the EFF and $1.3 billion under the RSF.

-

-

Why did India abstain from the IMF vote?

-

Due to concerns over potential misuse of funds and Pakistan’s track record with IMF programs.mint

-

-

What is the purpose of the RSF?

-

To support climate resilience initiatives in Pakistan over 28 months.

-

-

How many times has Pakistan received IMF assistance?

-

Pakistan has received disbursements in 28 of the past 35 years. Hindustan Times

-

-

What are the potential risks of the IMF bailout?

-

Misuse of funds, failure to implement structural reforms, and exacerbation of regional tensions.

-

-

How does the IMF monitor the use of its funds?

-

Through periodic reviews and conditionalities attached to disbursements.

-

-

What are India’s main concerns regarding the bailout?

-

Potential financing of state-sponsored terrorism and lack of accountability.

-

-

Has the IMF responded to India’s concerns?

-

The IMF acknowledged India’s statements but proceeded with the approval.www.ndtv.com+1Hindustan Times+1

-

-

What reforms has Pakistan committed to under the EFF?

-

Fiscal consolidation, energy sector reforms, and structural adjustments.

-

-

How will the RSF funds be utilized?

-

For projects aimed at enhancing climate resilience and sustainability.

-

-

What is the duration of the RSF program?

-

28 months.

-

-

How does this bailout affect Pakistan’s debt situation?

-

It provides temporary relief but adds to the overall debt burden.

-

-

What is the global community’s stance on this bailout?

-

Mixed; while some support it, others share India’s concerns.

-

-

Are there precedents for such bailouts amid geopolitical tensions?

-

Yes, but each case is unique and evaluated on its own merits.

-

-

What mechanisms are in place to ensure fund utilization?

-

IMF’s monitoring and conditionalities, along with domestic oversight.

-

-

How does this bailout impact India-Pakistan relations?

-

It adds another layer of complexity to already strained relations.

-

-

What are the implications for regional stability?

-

Depends on fund utilization and subsequent geopolitical developments.

-

-

How does the IMF balance financial assistance with geopolitical concerns?

-

By focusing on economic criteria, though geopolitical factors inevitably play a role.

-

-

What role does the IMF Executive Board play in such decisions?

-

It reviews and approves financial assistance packages based on staff recommendations.

-

-

Can member countries block IMF decisions?

-

They can influence decisions, but no single country has veto power.

-

-

What is the significance of India’s abstention?

-

It signals strong disapproval and raises questions about the IMF’s decision-making.

-

-

How does this bailout affect Pakistan’s economy in the short term?

-

Provides immediate relief and boosts investor confidence.

-

-

What are the long-term implications for Pakistan?

-

Dependent on successful implementation of reforms and prudent fund utilization.

-

-

How does the IMF ensure transparency in fund usage?

-

Through audits, reporting requirements, and regular reviews.

-

-

What are the potential consequences if funds are misused?

-

Suspension of disbursements and loss of credibility.

-

-

How does this bailout compare to previous ones?

-

Similar in structure but occurring under heightened geopolitical tensions.

-

-

What lessons can be learned from this situation?

-

The importance of accountability, transparency, and considering geopolitical contexts.

-

-

What is the role of other international financial institutions in Pakistan?

-

Institutions like the World Bank and Asian Development Bank also provide assistance.

-

-

How does public opinion in Pakistan view the bailout?

-

Mixed; some see it as necessary, others as a sign of economic mismanagement.

-

-

What steps can Pakistan take to ensure effective use of the funds?

-

Implementing reforms, enhancing transparency, and engaging stakeholders.

-

-

Conclusion: Time Will Tell🧠

The Pakistan IMF Loan 2025 is more than just numbers—it’s a test of accountability, reform, and diplomacy. With India watching closely and the world waiting for results, Pakistan must act responsibly.

Only time will tell if this $2.3B is a bailout—or a bandage.